Welcome to the world of wealth creation through real estate. This is your Real Estate 101 guide where you get to learn everything you need to know about real estate investment. Whether you’re just a beginner in real estate or you are looking to improve your knowledge in real estate investment, this is your guide to successful real estate investment.

Introduction:

Have you ever dreamed of a world where your wealth grows with every sunrise, not fueled by fleeting paychecks but by the sturdy foundation of bricks and mortars? Welcome to Real Estate 101, your guide to transforming your real estate dreams into a tangible reality.

Real estate investment has been a time-tested avenue for accumulating wealth and securing financial stability. However, embarking on a real estate investment journey without a foundational understanding is akin to navigating uncharted waters without a compass. It can feel like navigating a labyrinth of jargon, intimidating figures, and seemingly endless “dos and don’ts.” This guide is your map, carefully crafted to reveal the intricacies of the powerful asset class of real estate investing and equip you with the knowledge to confidently claim your stake in the lucrative world of real estate.

This comprehensive guide also aims to provide you clarity on the world of real estate and provide you with a strategic blueprint for wealth creation through property acquisition. So, whether you’re a novice with a burning entrepreneurial spirit or you’re a seasoned saver looking to refine and diversify in the area of real estate, sit back and grab a drink as we begin this journey on Real Estate 101 — where you discover the key to unlock the door to a brighter financial future.

Learn to identify diamond-in-the-rough properties and discover the secrets to building a portfolio that generates income while you sleep.

Get ready to demystify the market, unlock the secrets of smart investing, and watch your dreams solidify into a tangible, wealth-generating reality.

Let’s begin by defining what real estate is —

What is Real Estate Investment?

Real estate investment is simply the strategic acquisition, ownership, management, rental, or sale of real estate for profit. It encompasses a variety of property types, from residential homes to commercial spaces and even vacant lands.

As a powerful strategy for wealth-building, real estate has been employed by countless successful individuals around the world — through investing or accumulating real estate assets over time to gain profit. These assets include physical properties, such as land, buildings, and the natural resources that come with them. These assets are tangible and have the potential to generate income by appreciating over time.

Real estate has remained an age-old titan of wealth creation, and beckons with a timeless promise: stability, passive income, and a legacy built one property at a time. Understanding the basics is like holding the key to a treasure trove. Real estate has consistently proven to be one of the most lucrative and enduring forms of investment, offering the potential for long-term wealth creation. The value of real estate tends to appreciate over time, making it a reliable asset class for those seeking financial stability and growth.

Build Your Foundation: Understanding Key Concepts in Real Estate Investing

Before we begin to lay more bricks, it is important to first identify some key concepts about real estate investment. Think of this as your “Real Estate 101” vocabulary builder, equipping you to navigate the real estate market like a seasoned pro.

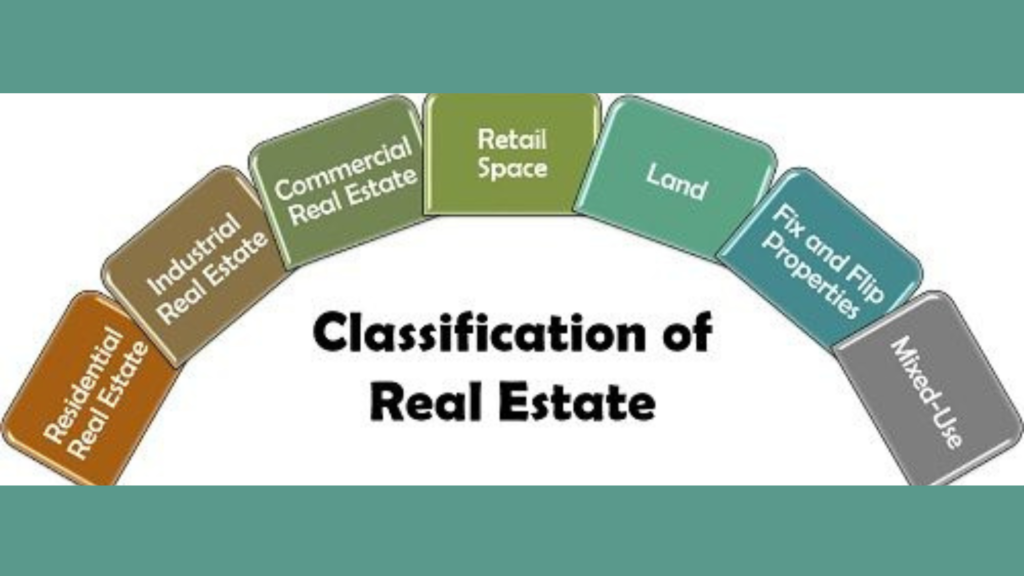

1. Asset Classes: Types of Real Estate Investing

Real estate isn’t a one-size-fits-all game. You’ve got different “playing fields” to choose from, each with its unique advantages and challenges. Here’s a quick tour:

- Residential Real Estate: Your classic houses, condos, and apartments. With this, think of steady income from rentals or potential flipping for profit.

- Commercial Real Estate: From office buildings to retail spaces, this sector caters strictly to businesses. Here, you can expect higher rents and longer-term commitments.

- Industrial Real Estate: Includes warehouses, factories, and logistics centers. This is the backbone of supply chains which offers considerable stable returns but potentially lower liquidity.

- Raw Land: Investing in raw land involves purchasing undeveloped properties. While they don’t generate immediate income, raw land investments can yield substantial profits through development or resale.

This Real Estate 101 guide does not limit you to sticking to one path. You can try to mix and match these classes and types of real estate investing to create a diversified portfolio that reflects your risk tolerance and goals.

2. Real Estate Investment Strategies: Finding Your Winning Formula

Now, let’s talk strategies!

Your strategy here is how you plan to build your successful portfolio. Think of it as your playbook for success in the real estate game. Here are a few popular options that are already being explored by most investors:

- Buy-and-Hold: This involves buying or acquiring a property, renting it out, and enjoying a steady income stream. It’s a classic long game – Ideal for passive investors seeking stable returns.

- Flipping: Here, you buy a property to fix it up and later sell it for a profit. This usually yields a faster turnaround but it requires renovation expertise and market timing skills.

- Fix-and-Flip: This involves buying a very distressed property and spending time to renovate or rebuild it, and later selling it for a much higher price. It’s a combination of flipping with a bit more TLC— ”tender, love and care towards a building”. Here, the investor faces higher risk but potentially higher reward too.

- Rental Income: This is your rental empire! It involves the purchase of multiple properties and generating income through rent payments. Requires continuous property management, but can be a steady source of passive income.

- REITs: Real Estate Investment Trusts can be a leverage for someone who is not ready for direct ownership of properties. Investing in REITs helps you own a piece of a diversified portfolio without the hassle of property management.

It’s important to state that this Real Estate 101 guide emphasizes that you understand your strengths to choose a strategy that aligns with your goals and risk tolerance. Don’t be afraid to explore and adapt – the right strategy is out there waiting for you!

3. Financing Options in Real Estate Investment: Building Your Ladder to Success

When starting as a real estate investor, don’t let the fear of hefty upfront costs hold you back. This Real Estate 101 gives you access to plenty of ways to finance your first property (and beyond). Let’s explore a few financing examples you can begin from:

- Mortgages: The classic way to leverage the power of debt. Choose the right loan term and interest rate to make your investment manageable.

- Loans: From personal loans to home equity loans, various financing options can help bridge the gap between your savings and your dream property.

- Crowdfunding: Tap into the power of the crowd! Platforms like real estate crowdfunding allow you to pool your resources with others to invest in larger projects.

Learning to be a smart borrower is key in real estate investing, especially if you’re just starting. Take your time to research, compare, and choose the financing option that best suits your needs and budget.

How to Get Started in Real Estate Investing

With the foundation now firmly in place, it’s time to get your sleeves rolled up and get your hands dirty! Let’s dive into the practical steps of this Real Estate 101 guide — getting you started on real estate by transforming your knowledge into taking meaningful action.

1. Real Estate Market Research: Your Shovel for Unearthing Gems

The first to do before you pick up your metaphorical trowel is to know where to dig. Imagine holding an imaginary shovel in your hand to begin digging — that’s your thorough market research which you need to unearth the hidden potential within your local terrain. Conducting your market research is very important before anything else.

Here’s what to focus on:

- Neighborhood Trends: Analyze property values, rental rates, and vacancy rates in different areas. Identify up-and-coming neighborhoods with high growth potential.

- Demographics: Understand who lives in your target area and what their housing needs are. Cater your investment strategy to their preferences.

- Economic Indicators: Keep an eye on job growth, interest rates, and overall economic stability to assess market conditions and predict future trends.

This Real Estate 101 guide emphasizes the importance of research and not guesswork. Become a data detective and gather all the information you need to make informed investment decisions.

2. Building Your Team: Uniting the Masterminds

No one builds a real estate empire alone. Surround yourself with a team of qualified professionals who can guide you every step of the way.

Here’s your dream team:

- Real Estate Agent: When navigating the real estate market, you need agents who are experts and are capable of helping you read the market. Real estate experts like Sinai Homes and Properties can help you find the right property and negotiate the best deal.

- Property Manager: If you’re going the rental route, a property manager handles tenant relations, maintenance, and day-to-day operations.

- Lawyer: Ensures all legal documents are in order and protects your interests throughout the process.

- Financial Advisor: Guides you in your financing options, budgeting, and tax implications of your investment.

Leveraging the expertise of others is critical to helping you navigate the real estate game smoothly. Do not hesitate to tap into your team’s knowledge and experience to ensure success in your wealth pursuit.

3. Budgeting and Analysis in Real Estate Investing: Building a Solid Foundation

Investing in real estate is not a sprint, rather you should see it as a marathon. This Real Estate 101 guide will help you make a realistic budget that considers all the costs involved, not just the purchase price. You must analyze all potential costs, create a realistic financial plan, and avoid overextending yourself. Take your time to plan.

Here are some terms that will help you better understand other costs you need to consider, and how to factor them into your budget before buying your next property:

- Down Payment: This is the amount you’ll need upfront to secure a mortgage.

- Closing Costs: The legal fees, inspections, and other miscellaneous expenses associated with the purchase.

- Renovations: If you’re planning any upgrades, factor in the cost of materials and labor.

- Maintenance and Repairs: Allocate funds for ongoing upkeep and unexpected repairs.

- Taxes and Insurance: Don’t forget about property taxes and homeowner’s insurance.

By knowing and following these essential budgeting steps in this Real Estate 101 guide, you’ll be well on your way to laying the foundation for a successful real estate journey.

How You Make Money with Real Estate Investment:

With your foundation laid and bricks stacked, it’s time to elevate your real estate journey to the next level — how you make good profit through real estate investment. Brace yourself up now for some advanced strategies and long-term growth tactics that establish you as a pro in the world of real estate.

1. Value Creation Strategies: Polishing Your Gemstone

Your property should not just be a static investment. How can you be proactive in creating value for your property? You must make it a living, breathing asset with the potential for continuous value growth. Analyze your property’s potential and implement strategies that make it stand out in the market.

Let’s explore a few ways you can polish your real estate gem:

- Strategic Renovations: Upgrade key areas like kitchens, bathrooms, or landscaping to boost rental income or resale value.

- Property Management Expertise: Optimize tenant relations, implement rent collection systems, and maintain the property to its full potential.

- Value-Add Services: Offer amenities like laundry facilities, pet-friendly policies, or co-working spaces to attract higher-paying tenants.

2. Diversification and Scaling: Building Your Empire Brick by Brick

The goal is not just to purchase one property, but that can be your starting point. Do not limit yourself to a single property. Growing rich in the game of real estate investing means diversifying your portfolio across different asset classes, and different locations, and exploring other investment strategies available.

But this also requires you to make calculated growth. Diversify strategically and scale up gradually, ensuring your portfolio remains stable and resilient.

Consider:

- Geographic Diversification: It involves spreading your risk by investing in properties in different markets to mitigate local economic fluctuations.

- Asset Class Expansion: Exploring commercial or industrial real estate to add different income streams and risk profiles to your portfolio.

- Scaling Up: As your experience and capital grow, consider larger projects like apartment buildings or development opportunities.

3. Staying Informed and Adapting: The Mastermind’s Secret Weapon

The real estate market is a dynamic beast, so you need the power of adaptability to stay at the top of the game. You will need to stay informed, keep analyzing the market, and be willing to pivot your strategies to ensure your portfolio thrives in any market climate.

Let’s explore a few ways to do this in this Real Estate 101 guide:

- Continuous Learning: Attend industry events, read industry publications, and network with other investors to stay updated on trends and regulations.

- Market Analysis: Regularly monitor economic indicators, neighborhood trends, and tenant preferences to adapt your strategies accordingly.

- Flexibility and Adaptability: Be prepared to adjust your course if market conditions change or new opportunities arise.

By implementing these advanced strategies, you’ll graduate from “Real Estate 101” to a seasoned investor, building a diversified and thriving portfolio for long-term wealth creation. Remember, the journey doesn’t end here – keep learning, keep adapting, and watch your real estate empire rise brick by magnificent brick!

Conclusion: From Bricks to Riches – Your Real Estate 101 Journey

Congratulations, you are now equipped with the requisite knowledge from this Real Estate 101 guide!

Proudly you have laid your foundation in real estate investing, stacked the bricks, and polished your investment gem. Now, step back and marvel at the blueprint you’ve created – a roadmap to wealth generation and long-term financial security through the power of real estate.

Remember, this Real Estate 101 guide wasn’t just about buying and selling properties. It was about unlocking your mindset to real estate investing — your way of thinking that sees opportunity in every corner, a ladder to climb toward financial freedom, brick by brick.

The Real Estate 101 guide is intended to get you started in real estate investing. Keep learning, keep growing, and keep your eyes peeled for new opportunities. This dynamic world of bricks and mortar holds endless possibilities for those who are willing to invest their time, their passion, and their unwavering belief in the power of real estate.

Now go apply your newfound knowledge, leveraging the strategies we’ve explored, and adapt to the ever-changing market landscape. Remember, there’s no one-size-fits-all path – find your rhythm through efficient research and market analysis. Build your empire, and let your real estate journey be a testament to your dedication and resilience.

What’s next?

We have emphasized the importance of continued learning to stay at the top of your game in real estate investing — Let us guide you on your real estate journey – we’re here to support you every step of the way! Click Here to get our newsletter delivered to your inbox

Have any questions or comments?

Share them with us in the comments below!